Key Person Insurance

What is key person insurance?

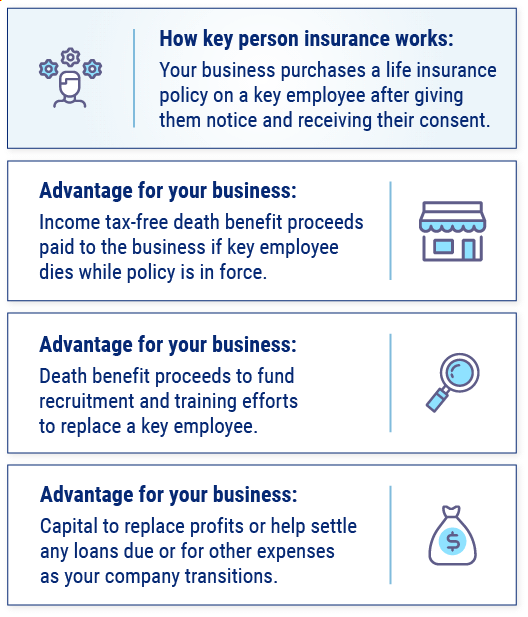

Key person insurance is a type of life insurance policy that provides a death benefit to a business if its owner or another significant employee passes away.

Key person insurance may make sense in many circumstances:

- If the business' reputation and financial viability are critically linked to the key employee's name, reputation or unique skills, and the key employee's death could end the business.

- If the death of a key employee (like a top salesperson) could quickly threaten the company financially.

- If a financial institution or other creditor needs collateral for a business loan and requires the option of putting a lien on a key person policy. (This is sometimes called collateral assignment.)

- If the business is a partnership and each partner wants to be able to buy out the other's shares in case of an untimely death.

How much coverage should I buy?

There's no set formula for deciding the monetary value of your key person insurance, says the III. You may want to start by considering the financial effects a key employee's death would have on your company.

For instance, if you're a sole proprietor buying key person insurance on yourself, you may want enough coverage to help your heirs close your business and pay off any company debts. If you own a larger company and are insuring a key employee, you may need enough coverage to replace that person's sales income, for example, or to provide a financial cushion while you search for the employee's replacement.

Who owns the key person policy and who benefits?

How your policy is structured may depend on your company's legal structure. Typically, the company pays premiums for the key person policy, and also owns it and is the beneficiary, says the III. The key employee must provide consent, in writing, to your company owning the policy.