Health Insurance

Plans for individuals and families

Essential+

Basic, reliable and low-cost without any extra benefits. Your monthly premium could be as low as $0, but you’ll pay more when you get care, compared to our other plans. Essential+ plans are available in the bronze metal level.

It’s a good fit if: You rarely see your doctor. You want a low-cost way to protect yourself from worst-case medical scenarios, like serious illness or injury.

Virtual First

This plan offers unlimited 24/7 $0 virtual care through the Galileo mobile app.^ The Galileo mobile app will be your first stop for all your care needs, from everyday to urgent — including primary and specialty care. Virtual First plans are available in bronze and silver metal levels.

It’s a good fit if: You like the convenience to text or have a video visit with a doctor instead of heading to the clinic.

This plan also offers the option to get your Galileo communications in Spanish and connect with a Spanish-speaking Galileo doctor right away

Value+

This plan offers low-copay primary care visits with your doctor, and an HSA option in a handful of states. Like our other plans, this plan also has you covered if you like the option for virtual care. Value+ plans are available in bronze, silver, and gold metal levels.

It’s a good fit if: You regularly see your doctor, and want something with a few more bells and whistles than the basic plan, without paying a lot for it.

few more bells and whistles than the basic plan, without paying a lot for it.

Advantage+

This is our richest plan with the most coverage. It’s closest to what you might expect from employer coverage. Used to having lots of coverage and perks, like dental and vision? This might be a good match. Advantage+ plans are available in silver and gold metal levels.

It’s a good fit if: You see your doctor often. You’re typically willing to pay a little more each month in order to pay less (lower, defined copays) when you get care.

Short term health insurance is a flexible health insurance coverage solution when you need coverage for a period of transition in your life.

Is short term insurance for me?

Short term insurance may be for you if you're:

- Unable to apply for Affordable Care Act (ACA), also called Obamacare, coverage because you missed Open Enrollment and you don't qualify for Special Enrollment

- Waiting for your ACA coverage to start

- Looking for coverage to bridge you to Medicare

- Turning 26 and coming off your parent's insurance

- Between jobs or waiting for benefits to begin at your new job

- Healthyand under 65

Download Short-Term Plan Brochure

Hospital and Doctor Indemnity Insurance

Hospital and doctor fixed indemnity insurance is also often called fixed-benefit insurance or fee for service insurance. That’s because this type of insurance pays you a fixed amount of money for specific services covered by the plan.

What is indemnity insurance?

A fixed indemnity plan like Health ProtectorGuard is much different than a major medical insurance plan.

A regular major medical health insurance plan pays for all or a percentage of covered expenses after you meet a deductible, pay a copay or reach a certain amount of out-of-pocket costs. Put simply, for qualified expenses, in most cases, you pay first, and then your insurance company covers the rest.

A fixed indemnity plan offers limited benefits and is meant to supplement a more traditional health insurance plan. Indemnity insurance essentially flips how you are paid when compared to major medical insurance. You or your provider are paid a predetermined fixed benefit for certain health care expenses you have incurred, and then you are on your own for the rest.

Unexpected medical bills can disrupt even the healthiest home budgets. It can help you deal with the unexpected by paying you or your provider a preset benefit amount for some of the most common medical costs you and your loved ones might face.

- Apply benefit payments toward your other health plan's deductible

- Get cash to help meet prescription drug copays

- Help pay your share of lab or diagnostic costs, like for blood tests or X-rays

- Have money for those unforeseen expenses surrounding a planned or an unplanned surgery

Learn about Health ProtectorGuard Fixed Indemnity Insurance

Critical Illness can strike at any time. We’ve all heard stories of friends or family members who have been affected by a serious illness. What we don’t hear is how the financial strain may also have a major impact during this trying time.

A primary health insurance plan may cover some health care costs, but oftentimes the patient will face other challenges such as paying everyday living expenses while out of work. That’s when a Critical Illness plan can come into play.

Advantages of a critical illness plan

- Tax-advantaged, cash benefit

- Flexibility to allocate money as needed

- Simple application of questions with yes or no answers

- Various maximum lifetime benefit amounts from $10,000 to $50,000

Download Critical Illness Brochure (United Healthcare)

Choosing a vision insurance plan

Vision insurance plans can help you better manage your vision care costs by giving you the benefits you may need to take care your eye health. Learn why choosing UnitedHealthcare branded vision plans underwritten by Golden Rule may help you get more of the benefits you want.

Download Vision Plan Brochure (United Healthcare)

Choosing a dental insurance plan

Choose from multiple dental plans with different levels of benefits to find the best dental insurance fit for your budget.Choose from a nationwide network of dentists who offer dental work to members at negotiated lower rates.

| Preventive care | Covers routine cleanings for all covered persons and fluoride treatments for those under the age of 16 on the plan, often with no deductible or waiting period. |

|---|---|

| Basic services | This often includes simple fillings or emergency treatment for dental pain. |

| Major services | This can include retainers and root canals. These are often subject to the plan’s deductible and waiting periods. |

| Access to a wide dental network | Including dental offices in both private and retail settings. |

| Direct payment to in-network dentists | No need to submit claim forms. |

| No age restrictions | Find coverage for every member of your family and every stage of life. Even if you are on Medicare, which doesn’t include dental benefits, we have plans designed specifically for seniors. |

Download Dental Brochure (United Healthcare)

Get a Quote Today

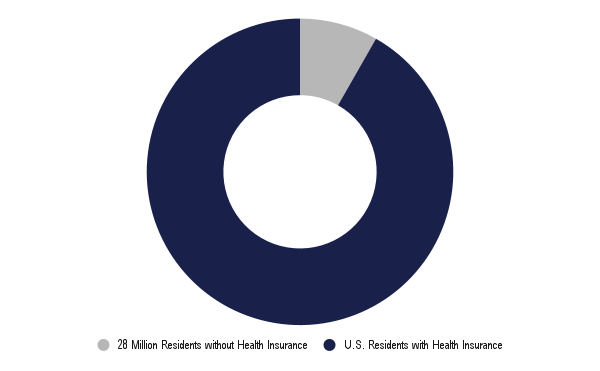

Today, approximately 90 percent of U.S. residents have health insurance with significant gains in health coverage occurring over the past five years. Health insurance facilitates access to care and is associated with lower death rates, better health outcomes, and improved productivity. Despite recent gains, more than 28 million individuals still lack coverage, putting their physical, mental, and financial health at risk.

Meaningful health care coverage is critical to living a productive, secure and healthy life. U.S. residents obtain health coverage from a variety of private and public sources, such as through their employers or direct purchase on the individual market (private sources), as well as through the Medicare, Medicaid, or Veterans Affairs programs (public sources).

The number of people with health insurance has increased significantly in recent years, with nearly 20 million individuals newly insured. Most of these individuals were able to enroll in coverage offered through the Medicaid program, their employer, or the individual market as a result of coverage programs and insurance market reforms authorized by the Affordable Care Act (ACA).